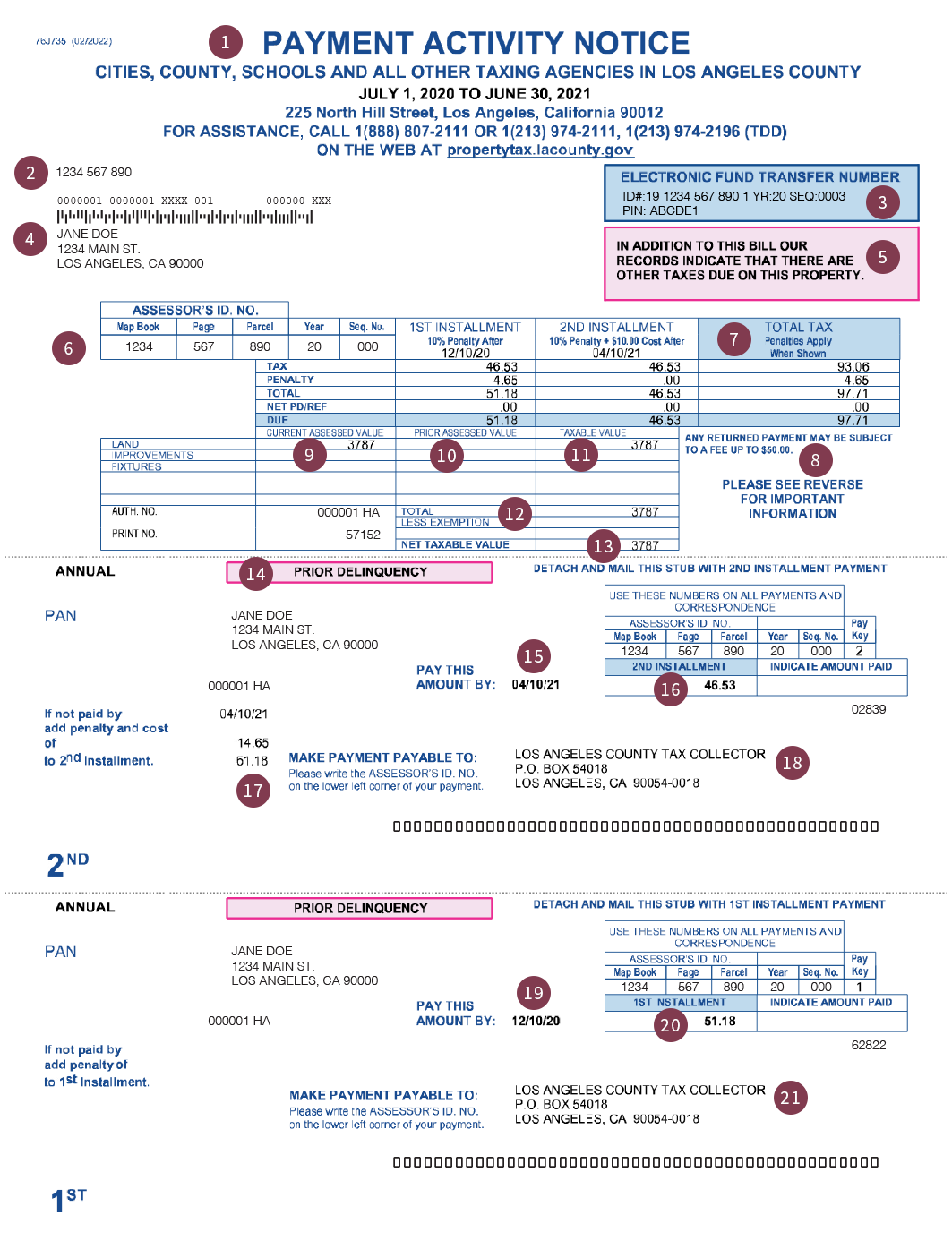

Payment Activity Notice

Please click on any number to view the description of the bill component. You may also scroll down to the bottom of the page to view a complete list of field descriptions.

Payment Activity Notice - The Payment Activity Notice alerts taxpayers that our records reflect a penalty was imposed on the first installment of their property tax bill. The penalty was imposed for one or more of the following reasons: no payment was received, a partial payment was received, or the first installment payment was received after the delinquency date.

Assessor's Identification Number - This area identifies the Assessor’s Identification Number – (1234-567-890). The Assessor’s Identification Number (AIN) is a ten-digit number assigned by the Office of the Assessor to each piece of real property in Los Angeles County. This ten-digit AIN is made up of a four-digit Map Book Number (1234), a three-digit Page Number (567), and a three-digit Parcel Number (890).

Electronic Fund Transfer (EFT) Number - The EFT number is used to make credit card/Visa Debit card payments over the telephone. To initiate a credit card/Visa Debit card payment, please call 1(888) 473-0835. However, there are processing fees when paying by credit card/Visa Debit card. Each transaction is limited to $99,999.99. The PIN number is used to make electronic check payment to protect your security and privacy and is used to pay your current year and defaulted taxes online. Effective with tax bills issued after August 2013, the PIN may contain all alpha, all numeric, or alpha/numeric characters. The alpha letter 'O' is not used in the PIN. The '0' is always a number zero.

Assessee - The owner of record and the mailing address on file with the Office of the Assessor.

Special Information - This section provides important information about the bill and states whether there are any delinquent taxes owed.

Assessor's Identification Number - This area identifies the Assessor’s Identification Number – (1234-567-890). The Assessor’s Identification Number (AIN) is a ten-digit number assigned by the Office of the Assessor to each piece of real property in Los Angeles County. This ten-digit AIN is made up of a four-digit Map Book Number (1234), a three-digit Page Number (567), and a three-digit Parcel Number (890).

Total Taxes Due - This is the total amount due for the bill. The Annual Secured Property Tax Bill has two payment stubs. The first installment is due November 1 and is delinquent December 10. If the first installment is not received or United States Postal Service (USPS) postmarked by December 10, a 10 percent penalty will be imposed. The second installment is due February 1 and is delinquent April 10. If the second installment is not received or USPS postmarked on or before April 10, a 10 percent penalty and a $10.00 cost will be imposed. Taxpayers must be sure to include the payment stub with any type of payment and write their Assessor's Identification Number with the Year/Sequence Number on their check.

Returned Check Charge – There is a $50.00 charge for any checks returned by the bank.

Current Assessed Value - The Assessor’s valuation of the property after the adjustment.

Prior Assessed Value - his is the Assessor’s valuation of the property prior to the recent transfer/new construction date.

Taxable Value - The current assessed value less the prior assessed value, if any.

Less Exemptions - Exemptions, if any, are deducted from the assessed value.

Net Taxable Value - The difference between the current value and exemptions.

Special Information - This section provides important information about the bill and states whether there are any delinquent taxes owed.

2nd Installment Delinquency Date - If paying the bill in installments the second installment must be received or United States Postal Service postmarked by this date, or a 10 percent penalty and a $10.00 cost will be imposed.

2nd Installment Due - Amount of taxes due for the second installment. Taxpayers must be sure to include the payment stub with any type of payment and write their Assessor’s Identification Number with the Year/Sequence Number on their check.

Remit Amount - If payment is not made by the delinquency date, remit the amount stated here. Include the payment stub(s) with the payment and write the Assessor’s Identification Number and the Year/Sequence Number on the check.

Make Checks Payable - Make checks payable to the Los Angeles County Tax Collector and mail to this address. Include the payment stub(s) with the payment and write the Assessor’s Identification Number and the Year/Sequence Number on the check.

1st Installment Delinquency Date - If paying the bill in full, payment must be received or United States Postal Service (USPS) postmarked by this date. If paying in installments, the first installment must be received or USPS postmarked by this date, or a 10 percent penalty will be imposed.

Remit Amount - If payment is not made by the delinquency date, remit the amount stated here.Include the payment stub(s) with the payment and write the Assessor’s Identification Number and the Year/Sequence Number on the check.

Make Checks Payable - Make checks payable to the Los Angeles County Tax Collector and mail to this address. Include the payment stub(s) with the payment and write the Assessor’s Identification Number and the Year/Sequence Number on the check.

Payment Activity Notice - The Payment Activity Notice alerts taxpayers that our records reflect a penalty was imposed on the first installment of their property tax bill. The penalty was imposed for one or more of the following reasons: no payment was received, a partial payment was received, or the first installment payment was received after the delinquency date.

Assessor's Identification Number - This area identifies the Assessor’s Identification Number – (1234-567-890). The Assessor’s Identification Number (AIN) is a ten-digit number assigned by the Office of the Assessor to each piece of real property in Los Angeles County. This ten-digit AIN is made up of a four-digit Map Book Number (1234), a three-digit Page Number (567), and a three-digit Parcel Number (890).

Electronic Fund Transfer (EFT) Number - The EFT number is used to make credit card/Visa Debit card payments over the telephone. To initiate a credit card/Visa Debit card payment, please call 1(888) 473-0835. However, there are processing fees when paying by credit card/Visa Debit card. Each transaction is limited to $99,999.99. The PIN number is used to make electronic check payment to protect your security and privacy and is used to pay your current year and defaulted taxes online. Effective with tax bills issued after August 2013, the PIN may contain all alpha, all numeric, or alpha/numeric characters. The alpha letter 'O' is not used in the PIN. The '0' is always a number zero.

Assessee - The owner of record and the mailing address on file with the Office of the Assessor.

Special Information - This section provides important information about the bill and states whether there are any delinquent taxes owed.

Assessor's Identification Number - This area identifies the Assessor’s Identification Number – (1234-567-890). The Assessor’s Identification Number (AIN) is a ten-digit number assigned by the Office of the Assessor to each piece of real property in Los Angeles County. This ten-digit AIN is made up of a four-digit Map Book Number (1234), a three-digit Page Number (567), and a three-digit Parcel Number (890).

Total Taxes Due - This is the total amount due for the bill. The Annual Secured Property Tax Bill has two payment stubs. The first installment is due November 1 and is delinquent December 10. If the first installment is not received or United States Postal Service (USPS) postmarked by December 10, a 10 percent penalty will be imposed. The second installment is due February 1 and is delinquent April 10. If the second installment is not received or USPS postmarked on or before April 10, a 10 percent penalty and a $10.00 cost will be imposed. Taxpayers must be sure to include the payment stub with any type of payment and write their Assessor's Identification Number with the Year/Sequence Number on their check.

Returned Check Charge – There is a $50.00 charge for any checks returned by the bank.

Current Assessed Value - The Assessor’s valuation of the property after the adjustment.

Prior Assessed Value - his is the Assessor’s valuation of the property prior to the recent transfer/new construction date.

Taxable Value - The current assessed value less the prior assessed value, if any.

Less Exemptions - Exemptions, if any, are deducted from the assessed value.

Net Taxable Value - The difference between the current value and exemptions.

Special Information - This section provides important information about the bill and states whether there are any delinquent taxes owed.

2nd Installment Delinquency Date - If paying the bill in installments the second installment must be received or United States Postal Service postmarked by this date, or a 10 percent penalty and a $10.00 cost will be imposed.

2nd Installment Due - Amount of taxes due for the second installment. Taxpayers must be sure to include the payment stub with any type of payment and write their Assessor’s Identification Number with the Year/Sequence Number on their check.

Remit Amount - If payment is not made by the delinquency date, remit the amount stated here. Include the payment stub(s) with the payment and write the Assessor’s Identification Number and the Year/Sequence Number on the check.

Make Checks Payable - Make checks payable to the Los Angeles County Tax Collector and mail to this address. Include the payment stub(s) with the payment and write the Assessor’s Identification Number and the Year/Sequence Number on the check.

1st Installment Delinquency Date - If paying the bill in full, payment must be received or United States Postal Service (USPS) postmarked by this date. If paying in installments, the first installment must be received or USPS postmarked by this date, or a 10 percent penalty will be imposed.

Remit Amount - If payment is not made by the delinquency date, remit the amount stated here.Include the payment stub(s) with the payment and write the Assessor’s Identification Number and the Year/Sequence Number on the check.

Make Checks Payable - Make checks payable to the Los Angeles County Tax Collector and mail to this address. Include the payment stub(s) with the payment and write the Assessor’s Identification Number and the Year/Sequence Number on the check.